Formula to calculate depreciation rate Method 2. Depreciationx Depreciation Of Fixed Assets Learning Objectives U2022 Define And Explain Depreciation U2022 Identify The Cause Of Depreciation U2022 Course Hero.

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

GOVERNMENT OF MALAYSIA Malaysian Public Sector Accounting Standards MPSAS 17 Property Plant and Equipment March 2013.

. The annual depreciation would amount to 1000 ie. September 14 2021 Post a Comment. Accelerated capital allowances Example of assets which qualify for accelerated capital allowance rates.

IA is fixed at the rate of 20 based on the original cost of the asset at the time when the capital was obtained. Annual depreciation Depreciation rate x Depreciable base. Entitlement to claim Legal ownership is required for a claim to tax depreciation.

Fixed Asset Depreciation Rate In Malaysia. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia for 5 consecutive YAs. Therefore its annual depreciation will be.

Use our automated self-help publications ordering service at any time. Annual depreciation expense Position of the current month in the fiscal year 12 100000 JPY Total depreciation expense that has been posted from January through the. The next step would be to divide the annual depreciation 1000 by the cost of assets 6000.

Any fixed assets that are not prescribed. Calculation of annual depreciation. For instance an asset expected to last five years would depreciate by one-fifth of its ticket price each year.

The annual allowance is distributed each year until the capital expenditure has been fully written off. Hence the annual depreciation rate would be 1667. Worldwide Capital and Fixed Assets Guide 2021 7 1.

Depreciation refers to the decrease in value of an asset over a period of time. For Asset Class say Office Equipments Initial Allowance is 20 and Annual Allowance is 10 That means depreciation will be calculated 20 on the acquisition value immediately upon acquisition for one time. An entity using the cost model for investment property in accordance with MPSAS 16.

The asset is depreciated on a straight-line basis. Small-value assets not exceeding RM2000 each are eligible for. Straight Line Method.

Taxes Taxes on income are generally not deductible whereas indirect taxes are deductible. Various kinds of vehicles. The total depreciation expense that has been incurred since the beginning of the year.

Under this method the rate of depreciation is to be applied on the original cost of asset every year to calculate the amount of depreciation. Allocation of tangible assets to tax depreciation lives and rates Several tax opinions have expressed that if a movable asset is part of a building but does not constitute a sole unit with the. MPSAS 17 -Property Plant and Equipment 1.

On 31 December 20X6 the remaining useful life of the plant was estimated to be three years with an estimated residual value of 12000. You need to know the full title Guide to depreciating assets 2022 of the publication to use this service. Rate of depreciation applicable on the asset is 14.

We have a requirement to calculate Tax Depreciation for Malaysia with reference to the Capital AllowanceThe scenario is like this. Depreciated replacement cost is the current acquisition cost of an asset substituted for cost in the balance sheet after deducting accumulated depreciation and accumulated impairment losses thereon. Phone our Publications Distribution Service on 1300 720 092.

Diminishing value depreciation Under diminishing value depreciation an asset loses a higher percentage of its value in the first few years. Annual allowance is a flat rate given annually according to the original cost of the asset. 5000 6000-1000 divided by 5.

Expenditure on an asset with a life span of not more than 2 years is allowed on a replacement basis. Required Explain how depreciation would be calculated for. Connect with an advisor now simplify you.

Depreciable amount is the cost of an asset or other amount substituted for cost in the financial statements less its residual value. Furniture is expected to last longer perhaps 5 years and would therefore be more likely to be depreciated at 20 per year. 20182019 Malaysian Tax Booklet Personal Income Tax 20182019 Malaysian Tax Booklet 24 2.

Accounting treatment for these assets including depreciation are prescribed by this Standard. The tax depreciation rates of fixed assets as prescribed under the Income Tax Regulations are as follows. Under this method the asset depreciates the same amount every year till it has zero value.

200000 as on 01042020 and initialized on the same day in the premises of business. IT equipment typically has an expected life span of 3 years and therefore it is typically depreciated over 3 years exactly which is 333 per year. The deduction is limited to 10 of the aggregate income of that company for a year of assessment.

Fines and penalties Fines and penalties are generally not deductible. Furniture and fittings installed in buildings. For example an asset is purchased for Rs.

You can speak to an operator between 800am and 600pm Monday to Friday. 020 x 12000 2400. During the computation of gains and profits from profession or business taxpayers are allowed to claim depreciation on assets that were acquired and used in their profession or business.

The depreciable base for the car stated in the previous example corresponds to its purchase price which is 12000. The Income Tax Act 1962 has made it mandatory to calculate depreciation.

3 Fundamental Question For Accountant In Malaysia 1 Fundamental Accounting Financial Year End

Training Modular Financial Modeling Historical Forecast Model Forecasts Debt Modano

Fixed Asset Management Software Xero Us

Reclassify Fixed Assets Finance Dynamics 365 Microsoft Docs

Training Modular Financial Modeling Historical Forecast Model Forecasts Debt Modano

Training Modular Financial Modeling Historical Forecast Model Forecasts Debt Modano

Asset Management Software Fixed Asset Management System Service Provider From Gurgaon

Training Modular Financial Modeling Historical Forecast Model Forecasts Debt Modano

Training Modular Financial Modeling Historical Forecast Model Forecasts Debt Modano

Training Modular Financial Modeling Historical Forecast Model Forecasts Debt Modano

Fixed Asset Management Software Xero Us

Journal Entries Disposing Selling Fixed Assets Youtube

Fixed Asset Management Software Xero Us

Fixed Assets Annual Report Cont Ppt Powerpoint Presentation Styles Format Ideas Powerpoint Templates

What Are The Audit Procedures To Verify The Fixed Assets Asset Infinity

Fixed Asset Reconciliation The Purpose And Use Trc Consulting

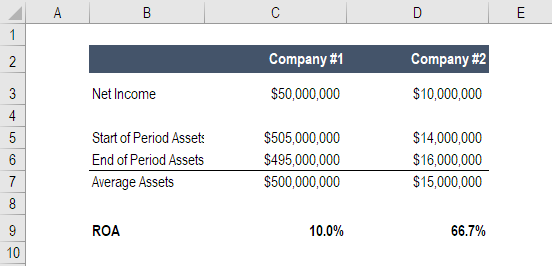

Return On Assets Roa Formula Calculation And Examples

Accumulated Depreciation Definition Formula Calculation

Fixed Asset Management Software Xero Uk